The two systems theory of behavioral finance idea is that people make decisions using two distinct sets of procedures—the first acts quickly and impulsively without thinking. The first depends on heuristics and prior knowledge/experience, but it is impulsive, quick, emotional, and acts without thinking. Our decision-making system’s second component is a more analytical, thoughtful thought process capable of processing information beyond our personal experiences. It implies that people might follow illogical options if their impulsive nature reacts most strongly. For instance, making “impulse buys” that don’t deliver a good return.

Behavioral Finance: An Understanding

Behavioral finance combines the discipline of psychology with economics and finance. The boundaries of arbitrage and cognitive psychology are the two pillars of behavioral finance. Mental refers to human thought processes. Numerous psychological studies have shown that people consistently make mistakes in their thinking, such as overestimating their abilities or placing undue emphasis on recent experiences. Distortions may also result from their choices. Behavioral finance takes advantage of this corpus of information instead of adopting the arrogant stance that should be disregarded.

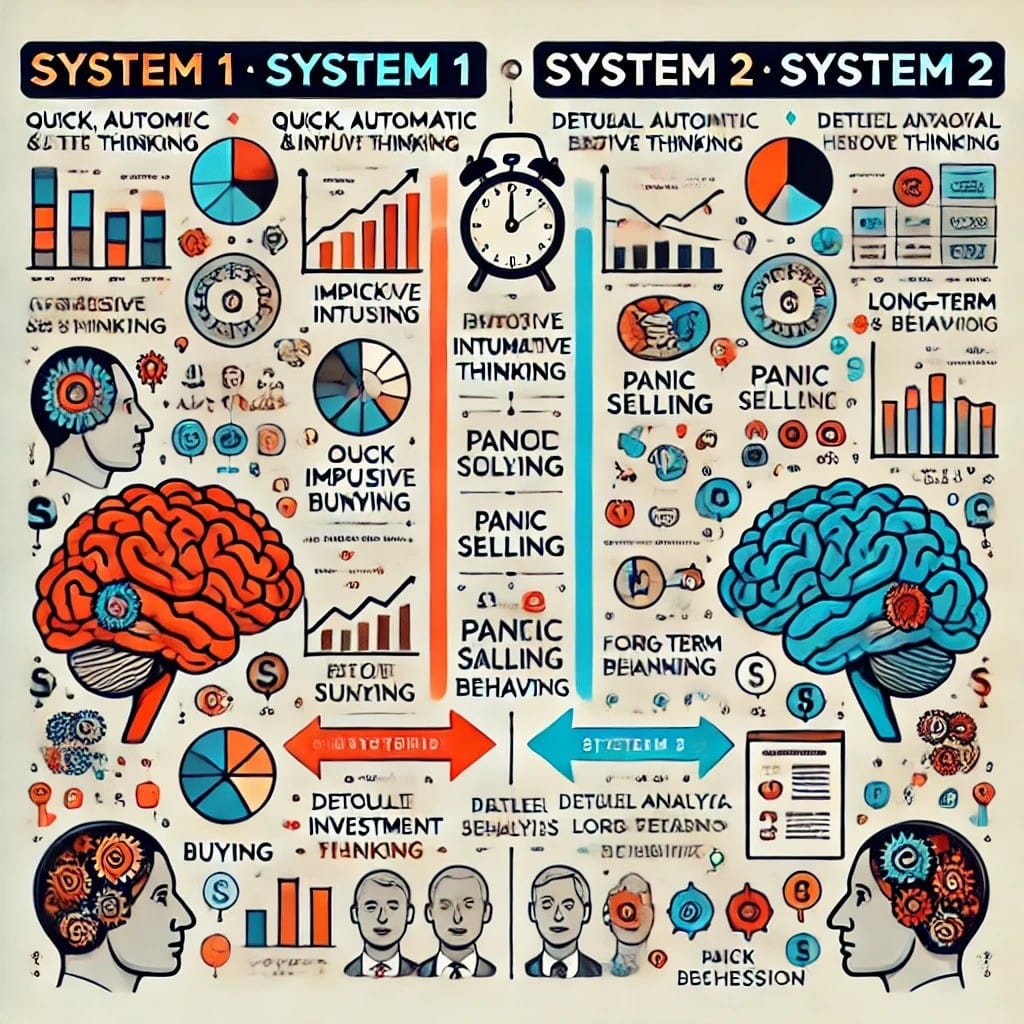

Nobel Prize-winning psychologist Daniel Kahneman, who has studied behavioral finance extensively, describes how the human brain comprises two systems. System 1 is the fight-or-flight portion of our minds, and it functions automatically and reflexively. System 2 allows for complex and sophisticated mental reasoning.

The Two Systems Theory of Behavioral Finance

Daniel Kahneman developed two modes of cognitive processing in his book Thinking, Fast and Slow. These are referred to as System 1 and System 2 thinking. System 1 requires little to no effort and is quick, automated, and intuitive. Since it is based on patterns and experiences, we can quickly reach decisions and conclusions with this way of thinking. System 1 is sometimes called the “gut feeling” way of thinking because it uses heuristics—a mental shortcut—to help it make judgments quickly and effectively.

System 2, however, requires conscious, deliberate, and steady effort. This thinking is employed when tackling complicated problems and doing analytical activities that require additional thought and analysis. System 2 is used when the material being delivered is novel, intricate, or calls for deliberate consideration. It is commonly called the “thinking” style of cognition since it necessitates laborious processing to conclude.

The Psychological Add Ons:

Heuristics:

Heuristics are more of a way of problem-solving that takes shortcuts during decision-making to come up with answers before a deadline. Due to their limitations, the outcomes of using various heuristics and biases in decision-making could be more robust. But in hindsight, they are adequate.

So, by using these shortcuts, our Fast System 1 brain saves us the mental strain of using our Slow System 2 brain. System 1 is also referred to as one’s gut instinct, best guess, or intuition. We consider the given data, draw a connection between it and our past experiences, and then decide. However, as was already said, these choices frequently need to be corrected.

Cognitive Biases:

Heuristics can cause cognitive biases. Cognition is the mental activity or process involved in gaining understanding and information. Some examples of cognitive functions are problem-solving, judgment, reasoning, remembering, and knowing.

Heuristics, often known as mental shortcuts, are methods we employ to solve problems. Cognitive bias is the term for a systematic mistake arising from applying heuristics in decision-making. This typically occurs when the heuristic isn’t in line with the environment. That can be because the climate has changed or you cannot analyze the environment correctly.

How These Systems Intertwine:

It is more plausible that the two types of thinking that cognitive psychologists call System 1 and System 2 originated from the same developed cognitive processes. System 2 thinking would have helped resolve complicated issues and make long-term decisions on survival and successful reproduction. According to Kahneman, nearly every process combines elements of both systems, and it’s critical to stress how complementary the two systems are.

Furthermore, biases affect both of them. Confirmation bias is an excellent illustration of how bias can impact both systems: it can cause us to notice and recall information that confirms our preexisting beliefs more quickly (a system one activity) and to be motivated to interpret new information in a way that confirms our preexisting beliefs (a system two activity).

In conclusion, human decision-making and institutions will always include a human component. However, by comprehending the functioning of the two systems theory of behavioral finance in the human mind, we may all make better investment choices and create better investment organizations.

Comments 1